As soon as this weekend, President Biden could announce a plan to cancel $10k in student debt per borrower, according to WaPo, citing three people with knowledge of the matter.

Biden could make the announcement at the University of Delaware’s commencement ceremony on Saturday. The plan would apply to Americans who earned less than $150k in the previous year or less than 300k for married couples filing jointly.

On April 6, the White House announced it would extend the pause of federal student loan repayments through August 31. It wasn’t clear if the administration would extend the moratorium beyond this.

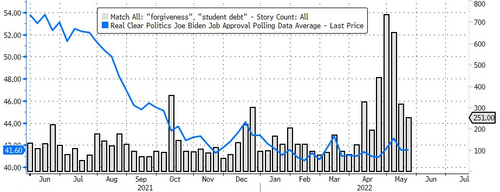

The decision to wipe out $10k of student debt per borrow who meets requirements comes as President Biden’s approval ratings collapse.

Notice how the number of stories in the news of “student debt loan forgiveness” is soaring ahead of the midterms, but Biden’s polling numbers remain cratered.

“No decisions have been made yet,” Vedant Petal, a White House spokesman, said Thursday.

The Committee for a Responsible Federal Budget, a nonpartisan think tank, said canceling $10k of student debt per borrower would cost a whopping $230bln.

WaPo said, “most of the nation’s 41 million student borrowers stand to benefit.” Though, who exactly benefits?

Goldman Sachs’ Jan Hatzius found canceling the debt would mainly benefit middle- and upper-income households, contrary to the administration’s claims it would help the working poor.

What this means, and just in time for the midterm elections in November, the Biden administration is trying to buy the loyalty of an entire generation by handing out free money. It comes as Democrats face an uphill battle in the elections.

Biden and Democrats rarely speak about the nasty consequences of student loan forgiveness; they only talk of the positives. As Peter Schiff recently pointed out:

Loan forgiveness would be like Christmas for colleges and universities. College administrators will figure, “Now we can really raise tuition because our students know they can borrow the money and they won’t ever have to pay it back.”

Peter said it won’t likely be a one-time thing. This will create a moral hazard.

If they do it once, they’re going to do it again. Everyone is going to expect it. … The moral hazard there is nobody is going to pay for college. Nobody is going to work to try to avoid going into debt because you’re an idiot. Take on the debt! It’s going to be forgiven.”

The second problem is the US government doesn’t have any money. It will have to borrow billions more to pay for any loan forgiveness scheme. Borrowed money has to be paid back by taxpayers, either in the form of higher taxes or inflation – likely both.

Student loan forgiveness would also pour more gasoline on the inflationary fire. It would be another massive stimulus program. If the Fed forgave $1.7 trillion in student loans, it would basically be like dropping $1.7 trillion from a helicopter.

Student debt cancellation is nothing more than pure vote-buying for Democrats that will only benefit middle- and upper-income households.